The idea of money laundering is very important to be understood for these working in the monetary sector. It is a course of by which soiled money is converted into clear money. The sources of the cash in precise are felony and the cash is invested in a method that makes it look like clean money and hide the id of the prison a part of the money earned.

Whereas executing the financial transactions and establishing relationship with the new customers or maintaining existing customers the obligation of adopting satisfactory measures lie on every one who is part of the organization. The identification of such element at first is simple to cope with as a substitute realizing and encountering such situations later on within the transaction stage. The central bank in any nation offers complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide enough safety to the banks to deter such conditions.

By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. Money laundering is defined broadly in Division 400 of the Criminal Code Act 1995 Criminal Code to include more than just concealing the proceeds or instruments of crime.

Money Laundering Meaning And Definition Tookitaki Tookitaki

N The process of hiding the source of illegal income by processing it through a large-turnover entity who takes a premium from it and then receiving the income from that entity to avoid suspicion.

Define the following term money laundering. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Money Laundering meaning in law Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. The money laundering process is divided into 3 segments.

Successful money laundering hides the illegal proceeds of a crime from the public eye. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Money laundering is the process of concealing illicit sources of money to make it appear like legitimately earned money.

The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Regardless of definitions the core meaning of the term is the process of turning illegally gained money into legal and lawful money with the purposes i to disguise original source of criminal or illegal money and ii to. The Placement Stage Filtering.

Criminals make the proceeds of crime appear to be legitimate in order to get away with their crime without raising suspicion. The Criminal Code makes it an offence to deal with the proceeds of crime or an instrument of crime. Criminals want their illegal funds laundered because they can then move their money through society freely without fear that the funds will be traced to their criminal deeds.

Money laundering is the term used to describe the act of taking illegal money from source A and making it look like it came from source B a legitimate legal source. The term money laundering started to draw attention in the early nineties and it has been defined in different ways. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate.

How does the Criminal Code define money laundering. Some common methods of laundering are. In addition laundering prevents the funds from being confiscated by the police.

Profit-motivated crimes span a variety of illegal activities from drug trafficking and smuggling to fraud extortion and corruption. Foreign Direct Investment explain in detail solve by typing dont with handwriting Question. Money laundering usually consists of three steps.

Money laundering is the act of disguising the original ownership identity and destination of the profits of a crime by hiding it within a legitimate financial institution and making it appear to have been acquired from a legal source. Money which is evidently the proceeds of a crime is referred to as dirty money and money which has been laundered to appear legitimate is referred to as clean money. Process of Money Laundering.

Defineexplain following terms in your own words any three. Defineexplain following terms in your own words any three. Placement layering and integration.

Money laundering is the process used to disguise the source of money or assets derived from criminal activity. Defineexplain following terms in your own words any three. Money laundering has been practised for over 6000 years but the term itself comes from the prohibition era of american history.

Layering Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that.

Money Laundering Define Motive Methods Danger Magnitude Control

Money Laundering Overview How It Works Example

What Is Anti Money Laundering Quora

Cryptocurrency Money Laundering Explained Bitquery

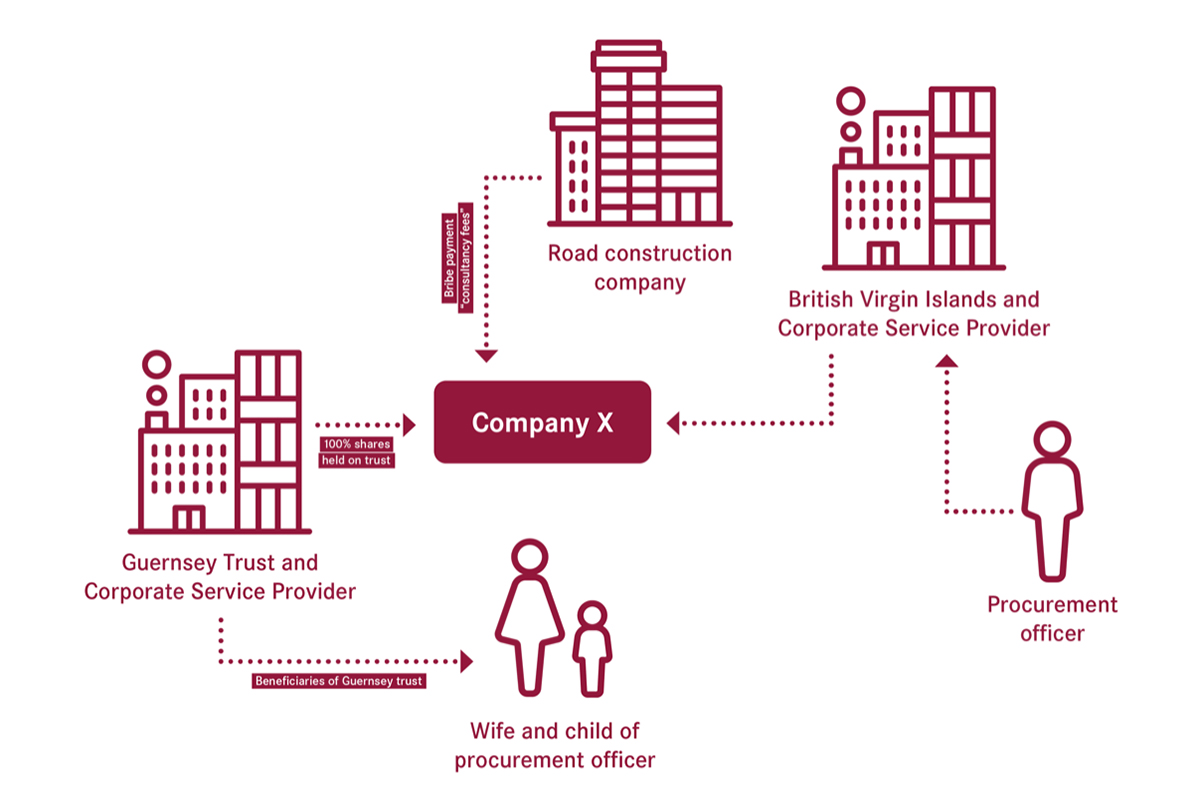

Phyllis Atkinson S Quick Guide To Offshore Structures And Beneficial Ownership Basel Institute On Governance

Pdf A Review Of Money Laundering Literature The State Of Research In Key Areas

Anti Money Laundering In The Eu Ceps

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

Anti Money Laundering 2021 Romania Iclg

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

What Is Money Laundering Three Methods Or Stages In Money Laundering

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

What Is Money Laundering And How Is It Done

The world of regulations can seem to be a bowl of alphabet soup at times. US money laundering regulations are not any exception. We have now compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Threat is consulting agency focused on defending monetary providers by decreasing risk, fraud and losses. Now we have massive bank experience in operational and regulatory risk. We've got a strong background in program management, regulatory and operational threat in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many hostile penalties to the organization as a result of risks it presents. It increases the probability of major dangers and the opportunity price of the financial institution and finally causes the financial institution to face losses.