The concept of money laundering is essential to be understood for these working within the financial sector. It is a course of by which dirty money is converted into clear money. The sources of the money in actual are felony and the cash is invested in a way that makes it appear to be clear money and conceal the identity of the legal part of the money earned.

While executing the monetary transactions and establishing relationship with the new customers or maintaining present clients the responsibility of adopting satisfactory measures lie on every one who is a part of the organization. The identification of such aspect to start with is simple to take care of as an alternative realizing and encountering such conditions in a while within the transaction stage. The central bank in any country offers complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide enough safety to the banks to deter such conditions.

PART VII - Politically Exposed Persons. Confirm an investor is a good fit before reaching out.

Procedure Consumer Due Diligence For Fintech Company Gaffar Co Law

Enhanced customer due diligence at payout.

Money laundering regulations 2017 customer due diligence. A identify the customer. This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 and the relevant customer due diligence. Identify your client and verify their identity on the basis of a.

Below we set out some key aspects of MLR 2017. Money Laundering Regulations 2017. Confirm an investor is a good fit before reaching out.

July 30 2017 by insolvencyoracle Leave a comment. Obligation to apply enhanced customer due diligence. Firms undertaking such business are required by the ML regulations regulation 10 to apply on a risk-sensitive basis enhanced customer due diligence measures.

A establishes a business relationship. It provides guidance which is of general application. This Practice Note provides guidance on customer due diligence CDD which is a central pillar of the anti-money laundering AML and counter-terrorist financing CTF regime.

Quickly validate potential targets. B carries out an occasional transaction that amounts to a transfer of funds within the meaning of Article 39 of the funds transfer regulation exceeding 1000 euros. 1 A relevant person may apply simplified customer due diligence measures in relation to a particular business relationship or transaction if it determines that the business relationship or.

Enhanced customer due diligence required. 1 This regulation applies when a relevant person is required by regulation 27 to apply customer due diligence measures. Regulation 37 of the MLR 2017 allows you to carry out simplified due diligence SDD where youre satisfied that the business relationship or transaction presents a low risk of money laundering or terrorist financing.

These new regulations need to be carefully considered along with the accompanying guidance. Customer due diligence measures. Ad Learn how to better vet companies and investors.

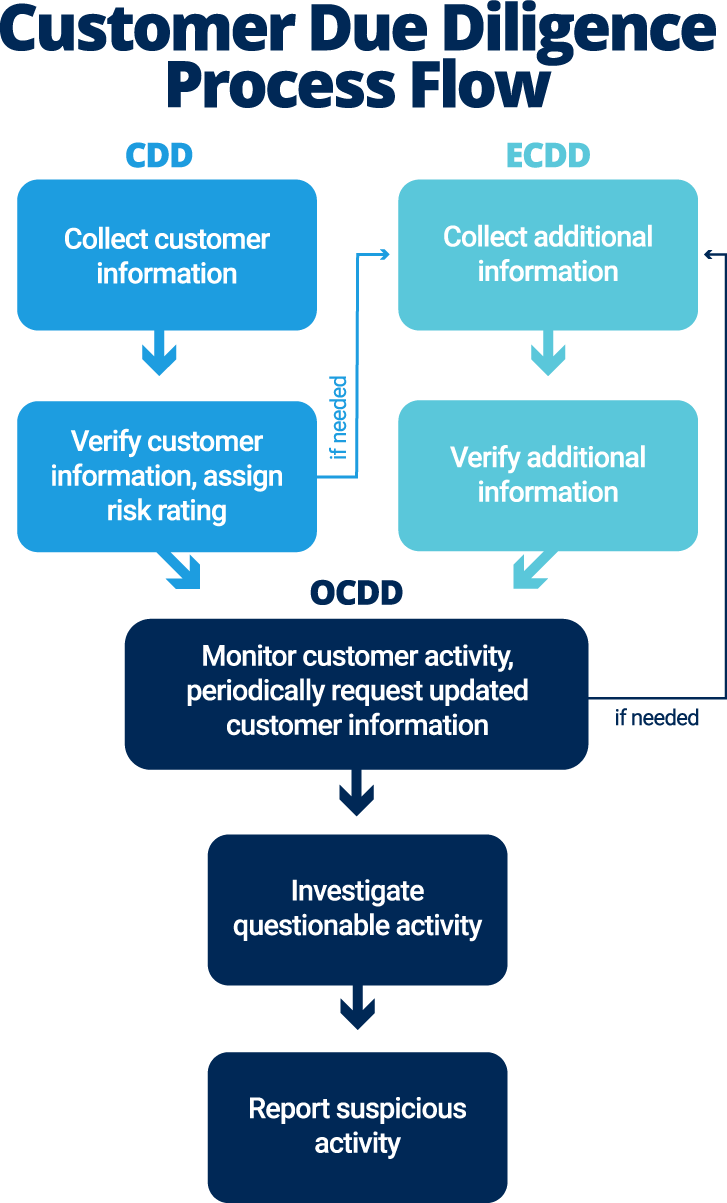

Simplified Due Diligence SDD Enhanced Due Diligence EDD Ongoing Customer Due Diligence Ongoing CDD Politically Exposed Persons PEPs Beneficial Ownership. Comply with new customer due diligence enhanced due diligence and simplified due diligence requirements Customer due diligence CDD Under the MLR 2017 you are required to. Quickly validate potential targets.

Additional requirements - politically exposed persons. This Practice Note explains customer due diligence CDD which is a central pillar of the anti-money laundering AML and counter-terrorist financing CTF regime. Customer Due Diligence after the Money Laundering Regulations 2017 and the Criminal Finances Act 2017 How do you ensure you conduct a thorough search for and provide ongoing monitoring of adverse information on existi.

Application of enhanced customer due diligence. Ad Learn how to better vet companies and investors. The impact assessment shows a net direct cost to businesses of 5.

The Anti-Money Laundering Regulations 2017. 1 A relevant person must apply enhanced customer due diligence measures and enhanced ongoing monitoring in addition to. Do you really know your customer.

Customer Due Diligence and more. 1 A relevant person must apply customer due diligence measures if the person. 72 Customer Due Diligence.

Money Laundering Regulations 2017customer due diligence. 1 A relevant person may rely on a person who falls within paragraph the third party to apply any of the customer due diligence measures required by regulation 282 to and but. Customer Due Diligence CDD Introduction.

C suspects money laundering. Find out what to look for. Find out what to look for.

PART VI - Enhanced Customer Due Diligence. Money Laundering Regulations 2017 part 2. The objective of the MLR17 is to make the financial system a hostile environment for illicit finance while minimising the burden on legitimate businesses.

CDD requirements underpin the Money Laundering Regulations 2017 MLR 2017 as amended.

Anti Money Laundering Policy Pdf

The Money Laundering Regulations 2017 Are Now In Force Are You Compliant Deloitte Uk

Money Laundering Regulations Definition Of Customer A Comparison Of Regulatory Approaches Can Help Inform Other Jurisdictions Decisions Regarding The Regulation Of Npm

Anti Money Laundering And Counter Terrorism Financing

Icyte Saved Page What Is Customer Due Diligence Cdd

How To Achieve Compliance In An Ever Changing World

Https Www2 Deloitte Com Content Dam Deloitte Uk Documents Financial Services Deloitte Uk Fs Money Laundering Regulation 2017 Brochure Pdf

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Aml Roadshow 2017 The New Ml Regulations What

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering A Practical Guide For Firms

Get Started With Customer Due Diligence Smartsheet

The world of regulations can seem like a bowl of alphabet soup at times. US money laundering rules are not any exception. We've compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Danger is consulting firm centered on defending monetary services by lowering danger, fraud and losses. We now have massive bank expertise in operational and regulatory threat. Now we have a strong background in program administration, regulatory and operational threat as well as Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many adversarial consequences to the organization due to the dangers it presents. It will increase the likelihood of major risks and the chance cost of the financial institution and in the end causes the financial institution to face losses.